boise idaho sales tax rate 2019

While many other states allow counties and other localities to collect a local option sales tax Idaho does not permit local sales taxes to be collected. Your free and reliable 2019 Idaho payroll and historical tax resource.

Rustic Acres 608 North Empress Street Mobile Home For Sale In Boise Id 1098574 Mobile Homes For Sale Rustic Mobile Home

Sales and property tax rates are relatively low in the state.

. This is the total of state and county sales tax rates. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. There is no applicable county tax city tax or special tax.

Idaho has one of the lowest average total sales tax rates of any state. Boise County ID Sales Tax Rate. Cascade - 208.

Some but not all choose to limit the local sales tax to lodging alcohol by the drink and restaurant food. The Boise sales tax rate is. Bovill ID Sales Tax Rate.

Idaho 2019 Tax Rates. The average is 603 making it the 16th highest average sales tax rate. Idaho has only 9 different active sales tax jurisdictions.

Below 100 means cheaper than the US average. Please check with Tax Reporting in advance if you are making out of state sales. Levy rates for 2019 in Boise were at their lowest levels in at least 10 years.

You can print a 6 sales tax table here. The Boise sales tax rate is. What is the sales tax rate in Boise County.

Contact the following cities directly for questions about their local sales tax. In Ada County property taxes will account for 47 of the countys 2019 budget a budget that has seen a 27 increase in the last 4 years alone. Blackfoot ID Sales Tax Rate.

The Boise County sales tax rate is. Idaho is not a member of the Streamlined sales tax SST. State Local Sales Tax Rates As of January 1 2020.

2035 Billion - 65 increase over 2018 or 125 Million Urban renewal agencies. A recent report from the Idaho State Tax Commission shows that for a typical family of three in Boise earning 75000 per year income taxes were 3 lower than the national average sales taxes 7 lower and property taxes 26 lower. Bonners Ferry ID Sales Tax Rate.

Idaho new hire online reporting. While the statewide sales tax rate is relatively high at 6 only a handful of cities charge a local sales tax. The state rate is 6 and the total rate can range as high as 9 when including local jurisdictions.

While taxing districts set their levy ratethe rate. The Boise Idaho sales tax is 600 the same as the Idaho state sales tax. 4 rows The current total local sales tax rate in Boise ID is 6000.

Bruneau ID Sales Tax Rate. This is how your levy rate is determined. Bloomington ID Sales Tax Rate.

Sales Tax on Food. Be sure to notify the Assessors Office at. This is the total of state county and city sales tax rates.

How Idaho Property Taxes Compare to Other States. 208-392-4415 whenever youre mailing address changes. Select year Select another state.

There are 19 that also. Average Sales Tax With Local. This is the rate you will be charged in almost the entire state with a few exceptions.

2020 rates included for use. The Boise Sales Tax is collected by the merchant on all qualifying sales made within Boise. The 6 sales tax rate in Boise consists of 6 Idaho state sales tax.

31 rows Ammon ID Sales Tax Rate. The personal exemption was eliminated starting in the 2019 tax year just as they were with federal income taxes. This can only increase each year by up to 3 plus growth.

Bonneville County ID Sales Tax Rate. Boise Idaho and Houston Texas Change Places. Bonner County ID Sales Tax Rate.

Real property tax on median home. Cities with local sales taxes. Idaho Sales Tax Rates By City County 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 Calculate your tax rate based upon.

The Idaho sales tax rate is currently. Taxidahogov Property Tax Essentials Property Tax is levied on real and business personal property First 100000 PP exempt per company per county Property Tax is generated and used locally 2019 Total property tax to local units of government. Thus you can expect to pay 6 in sales taxes unless you go to a handful of cities popular with tourists including Stanley and Sun Valley.

Be sure to keep accurate records receipts and cancelled checks documenting your payment. Idahos state sales tax is 6. The current sales tax rate in Idaho is 6.

The sales tax jurisdiction name is Boise Auditorium District Sp which may refer to a local government division. For tax rates in other cities see Idaho sales taxes by city and county. The minimum combined 2022 sales tax rate for Boise Idaho is.

Boundary County ID Sales Tax Rate. The County sales tax rate is. A levy rate of 014 rounded to three decimals means you owe 14 of taxes for every 1000 of your propertys taxable value.

The minimum combined 2022 sales tax rate for Boise County Idaho is. Sales Tax Facts. Their taxable income on Form 40 line 19 or Form 43 line 41 is 25360.

Brown are filing a joint return. Proof of payment of property Taxes is the responsibility of the Tax payer IC63-1306. Setup email alerts today Click Here.

We are continually reviewing sales tax reporting requirements for all states. 100 US Average. In the 2018 tax-year the property taxes collected across Idaho increased by 64 marking the highest increase in taxes paid in a decade.

Be the first to know about new foreclosures in an area. Boise ID Sales Tax Rate. Resort cities have a choice in whats taxed and can include everything thats subject to the state sales tax.

Like most taxes Idahos property taxes are lower than the national average. The Tax Reporting Department will remit and report the sales tax collected to the State of Idaho and all other states as necessary. Idaho has state sales.

The Idaho state sales tax rate is currently.

States With Highest And Lowest Sales Tax Rates

Idaho House Passes 600 Million Income Tax Cut And Tax Rebate Bill Idaho Capital Sun

Idaho S Grocery Sales Tax Is An Issue At Every Legislative Session Have Thoughts Let S Talk Idaho Capital Sun

Claim Your Grocery Credit Refund Even If You Don T Earn Enough To File Income Taxes Idaho Bigcountrynewsconnection Com

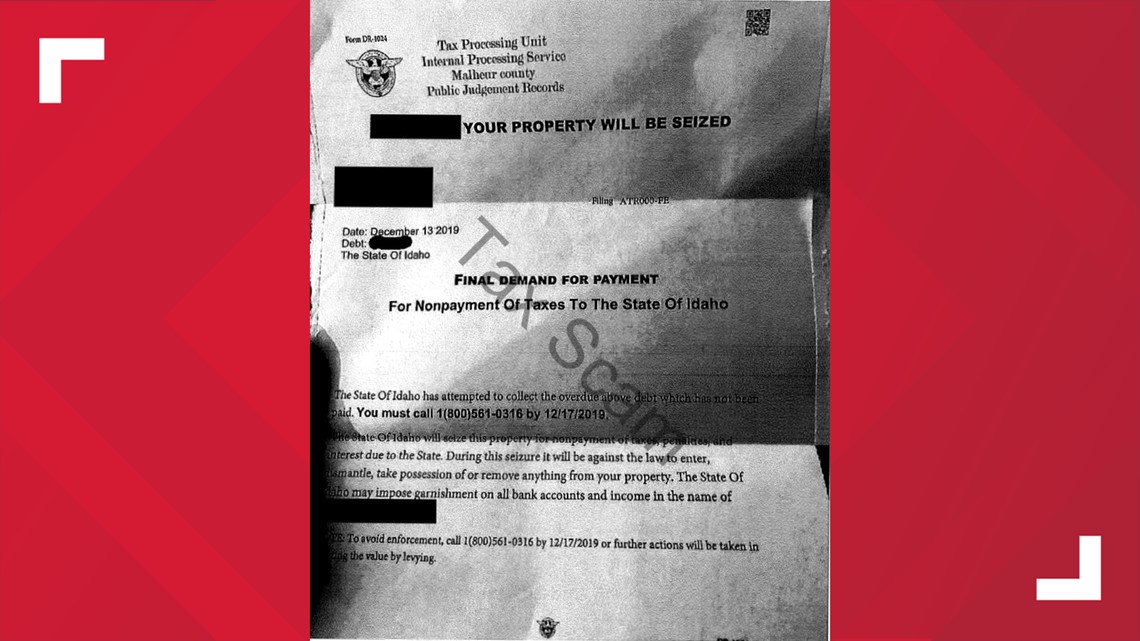

Idaho Tax Commission Renews Warning About Fraudulent Mailings Ktvb Com

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Total Sales Tax Per Dollar By City Oklahoma Watch

What S This Wayfair Fund I Keep Hearing About Idaho Reports

Idaho Income Tax Calculator Smartasset

Idaho Sales Tax Guide And Calculator 2022 Taxjar

Sales Tax Rates In Major Cities Tax Data Tax Foundation

States With Highest And Lowest Sales Tax Rates

Joyful Public Speaking From Fear To Joy Will Reducing Idaho S State Income Tax Rate Raise Our Family Prosperity Index

Texas Taxable Services Security Services Company Medical Transcriptionist Phone Service

This Is The Most Expensive State In America According To Data Best Life